*Disclaimer: The information provided here is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves risks, so please DYOR. For beginners, check out our Beginners Guides to learn more.

MEXC

MEXC: A Global Hub for Altcoin Trading and Derivatives

Founded in 2018 and registered in Seychelles, MEXC (formerly “MXC”) has evolved into a high-volume cryptocurrency exchange known for rapid token listings, deep derivatives markets, and aggressive fee promotions. Its positioning is clear: serve the global altcoin community with breadth of markets and offer fast, liquid venues for both spot and perpetual futures. While it competes with other altcoin-focused platforms, MEXC’s combination of 1,500+ listed assets, leveraged ETFs, and copy trading makes it a go-to venue for active crypto trading across digital assets.

Core Trading Platform

MEXC’s platform targets both newcomers and power users, with pro-grade charts, multi-order workflows, and extensive market coverage.

-

Spot Trading: MEXC lists 1,500+ assets and 2,000+ spot pairs, including majors like Bitcoin and Ethereum, as well as a constant stream of small-cap tokens. The exchange frequently runs 0% spot trading fee promotions; standard maker/taker rates are tiered and highly competitive when promotions are not active. Advanced orders (limit, market, stop-limit/market) and one-cancel-the-other (OCO) are available in a clean order-entry panel.

-

Perpetual Futures (Derivatives): MEXC offers USDT-M and coin-margined perpetuals with leverage of up to 200x on select contracts. Fees are tiered, with rates as low as ~0.00% maker and ~0.02% taker for high-tier accounts. Funding intervals are frequent, and the platform includes built-in position PnL calculators, bracket orders, and multi-trigger stops. While leverage expands possibilities, it also increases liquidation risk and requires disciplined risk management.

-

Leveraged ETFs: MEXC lists 2x/3x long/short ETF products (e.g., “3L/3S” tickers) to express directional views without direct margin management. These rebalance daily and can deviate from spot over time due to compounding—useful for intraday trading, but less suitable for long holding periods.

-

Earn and Staking Products: Through MEXC Earn, users can subscribe to flexible and fixed-term products on popular coins and stablecoins. Yield sources include on-chain staking, liquidity products, and promotional campaigns. If you’re new to yield, it’s useful to understand the mechanics via The Ultimate Beginner's Guide to Crypto Staking and core concepts from What is DeFi (Decentralized Finance)? before allocating funds.

-

Launchpad, Kickstarter, and M-Day: MEXC’s Launchpad and Kickstarter programs allow users to access early-stage or newly listed tokens by committing assets or voting. Allocation and eligibility vary by event and often tie into holding or using MX (the exchange token). These programs are a draw for price discovery but also carry higher volatility and project risk.

-

Copy Trading and Trading Bots: MEXC supports copy trading for futures, enabling users to follow top performers’ strategies with configurable risk parameters. Strategy templates include grid bots and DCA. Copy trading does not remove risk; improper sizing or following transient performers can amplify drawdowns.

-

P2P and Fiat On-Ramps: MEXC provides a P2P marketplace with escrow as well as third-party on-ramp partners in supported regions. Settlement methods and limits vary by country. KYC requirements apply for fiat rails and higher withdrawal tiers.

-

APIs and Institutional Features: REST and WebSocket APIs are available for market makers and quants, with VIP tiers, tighter fee bands, and enhanced rate limits for higher-volume accounts. Dedicated account managers are available for selected VIP levels.

Security Measures

MEXC implements layered defenses for accounts, infrastructure, and custody. Users can harden their profile with time-tested controls, while the platform emphasizes operational separation of funds and risk checks.

-

Account Security: Two-factor authentication (app-based TOTP), withdrawal address whitelisting, device management, and anti-phishing codes are standard. Security prompts encourage 2FA before enabling withdrawals or API keys.

-

Custody and Cold Storage: MEXC states that it stores the majority of client assets in multi-signature cold wallets. Hot wallets are tightly limited to support on-exchange settlement and withdrawals. For long-term holdings, many market participants prefer self-custody, which is worth reviewing in How to Safely Store Your Cryptocurrency.

-

Platform Security: Regular audits, DDoS mitigation, and real-time risk monitoring are part of MEXC’s posture. The exchange has not reported a headline-grabbing breach, though—like any centralized exchange—temporary withdrawal processing delays can occur during peak volatility or maintenance windows.

-

Operational Controls: Internal risk engines monitor abnormal trading activity, liquidations, and cross-market anomalies. Withdrawal queues, manual checks for large movements, and AML screening contribute to fraud prevention.

No centralized exchange is risk-free. Users should apply security best practices, maintain diversified custody strategies, and size positions thoughtfully—especially when trading derivatives.

User Experience

MEXC aims to balance pro depth with accessibility, providing multi-platform trading and bite-sized education.

-

Interface and Tools: The web terminal includes TradingView-powered charts, depth and order flow panels, multi-asset watchlists, and one-click toggles between spot, futures, and ETFs. The futures workspace supports cross and isolated margin modes, hedged positions, and multi-trigger stops.

-

Mobile Apps: iOS and Android apps mirror core web features, including deposits/withdrawals, transfers between sub-accounts, and notifications for order fills and margin calls. Face ID/biometrics are supported on compatible devices.

-

Education and Onboarding: MEXC Academy and its blog-oriented content cover platform basics, risk controls, and event mechanics like Launchpad and Kickstarter. If you’re completely new to digital assets, Crypto for Beginners and Understanding Crypto Exchanges provide helpful context before placing your first trade.

-

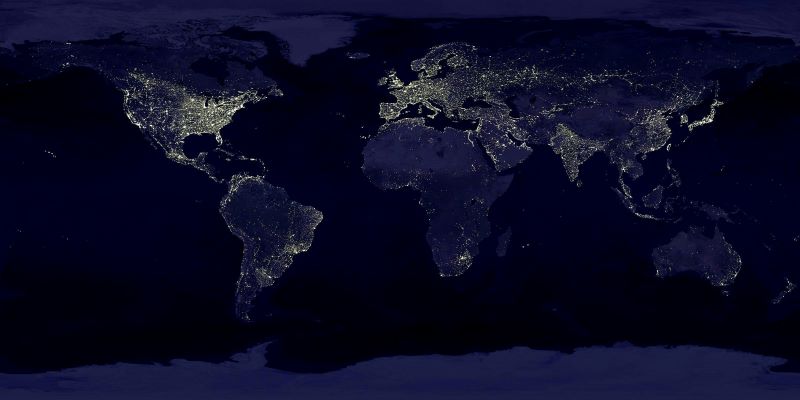

Support and Languages: 24/7 live chat support is available, with email ticketing for more complex issues. The interface supports many languages across Europe, Asia-Pacific, MENA, and LATAM, making onboarding straightforward for global users.

For day-to-day market awareness, some traders also track sentiment indicators such as the Fear and Greed Index to frame risk-taking and de-risking cycles.

Regulatory Compliance and Licensing

MEXC operates as a global platform with corporate registration in Seychelles and regional entities serving multiple markets. The exchange employs KYC/AML screening, transaction monitoring, and risk-based controls, especially for fiat on-ramp access and higher withdrawal tiers.

-

Licensing Footprint: MEXC does not operate as a registered entity for retail customers in the United States and restricts access by U.S. persons. Availability and feature sets vary by jurisdiction, and derivative products may be limited or unavailable in certain countries.

-

Compliance Practices: KYC verification tiers determine deposit/withdrawal limits, access to fiat partners, and P2P privilege levels. The platform uses analytics tools for chain surveillance and may request additional verification for flagged activities.

-

Proof-of-Reserves and Transparency: MEXC has periodically published wallet transparency materials and asset reserve snapshots. Users should monitor official announcements for the latest PoR methodology, frequency, and scope.

If you prioritize U.S.-style regulatory coverage and domestic custody solutions, you may find a better fit with a U.S.-oriented platform; if you prioritize breadth of tokens and perps liquidity, MEXC is positioned alongside altcoin-heavy venues like KuCoin and derivatives specialists like Bybit.

MX Token and Ecosystem Programs

MEXC operates its own native utility token, MX, which serves multiple functions within the ecosystem:

-

Fee Utility: Holding MX can reduce trading fees, and certain promotions require minimum MX balances for elevated perks or VIP tiers.

-

Event Access: MX holders often receive preferential access or boosted allocation odds in Launchpad, Kickstarter, and M-Day events, creating a core community of traders who engage early with token listings.

-

Burn Mechanics: MEXC has conducted regular burns of MX based on revenue or event-driven schedules, positioning MX as a deflationary exchange token. As with all exchange tokens, demand is tied to platform activity and the perceived value of perks.

As an exchange utility token, MX’s performance is correlated with MEXC’s user growth, trading volumes, and the ongoing attractiveness of its listings and programs.

Points to Consider

-

Fees and Liquidity: MEXC frequently runs 0% spot fee promos and competitive futures taker rates. For thinly traded pairs, spreads and depth can vary—confirm order book liquidity before placing larger trades.

-

Derivatives Complexity: Perps offer up to 200x leverage, which magnifies both gains and losses. Funding costs, index price sources, and liquidation rules matter; always test sizing and stops on small positions first.

-

Token Listings and Due Diligence: MEXC lists many early-stage and micro-cap tokens. Quality is uneven by design in discovery markets. Practicing disciplined research is essential; start with The Importance of DYOR (Do Your Own Research) and stay alert to patterns highlighted in Crypto Scams: How to Spot and Avoid Them.

-

Custody Strategy: Centralized exchanges are convenient for trading, but long-term holdings may be better secured in self-custody solutions. Refresh best practices in How to Safely Store Your Cryptocurrency and maintain backups of recovery materials.

-

Geographic Restrictions: Availability, KYC tiers, and access to derivatives/P2P can vary by region and may change. Confirm your local policy page and product eligibility before onboarding capital.

Conclusion

MEXC has carved out a strong position as an altcoin-forward cryptocurrency exchange with an expansive spot market, competitive perpetuals, leveraged ETFs, and community-driven events like Launchpad and Kickstarter. Its strengths include rapid listings, fee promotions, and a feature-rich terminal across web and mobile. On the other hand, its global-first model means availability and product sets vary by jurisdiction, and the abundance of early-stage tokens requires careful diligence. For active traders seeking breadth and derivatives depth, MEXC is compelling; for users who prioritize domestic licensing or a narrower, blue-chip focus, it may be worth balancing MEXC with regionally regulated alternatives. Overall, MEXC is best suited to intermediate and advanced users who value market breadth, speed, and flexible tooling—and who pair that with solid risk management.

Visit Exchange

Learn more about this cryptocurrency exchange platform

We may earn a commission at no extra cost to you. This is not financial advice. Cryptocurrency exchanges involve significant risks, including potential loss of all funds. Always verify the platform is legal in your jurisdiction and never invest more than you can afford to lose.

Explore other platforms on our Exchanges page or learn more about exchanges and brokers in general in our guide: Understanding Crypto Exchanges.