*Disclaimer: The information provided here is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves risks, so please DYOR. For beginners, check out our Beginners Guides to learn more.

Bitget

Bitget: Global Crypto Exchange Built Around Copy Trading and Derivatives

Bitget has carved out a distinct identity among centralized cryptocurrency exchanges by leaning into copy trading at scale and maintaining a strong derivatives suite for active traders. Founded in 2018 and registered in Seychelles, the platform serves a global user base with a broad catalog of digital assets, yield products, and a rapidly expanding Web3 wallet ecosystem.

Positioned as a derivatives-first venue with robust copy-trading features, Bitget appeals to traders seeking advanced tools, flexible automation, and high-liquidity perpetuals alongside familiar spot markets. Its ecosystem also includes Bitget Earn products, strategic listings, and an integrated self-custody wallet (via Bitget Wallet, formerly BitKeep) that connects users to DeFi and multi-chain swaps—bridging centralized and decentralized finance in one brand.

Key context for prospective users: Bitget continues to emphasize security through a public Proof of Reserves program and a sizable protection fund, while iterating on education (Bitget Academy) and user support to bring in both crypto beginners and professionals. Its market position is competitive among high-volume exchanges, particularly for users who value social trading, automation, and futures liquidity.

Core Services

Bitget’s core offerings span spot, derivatives, copy trading, and a suite of yield and automated strategies designed for diverse experience levels.

-

Trading Platform:

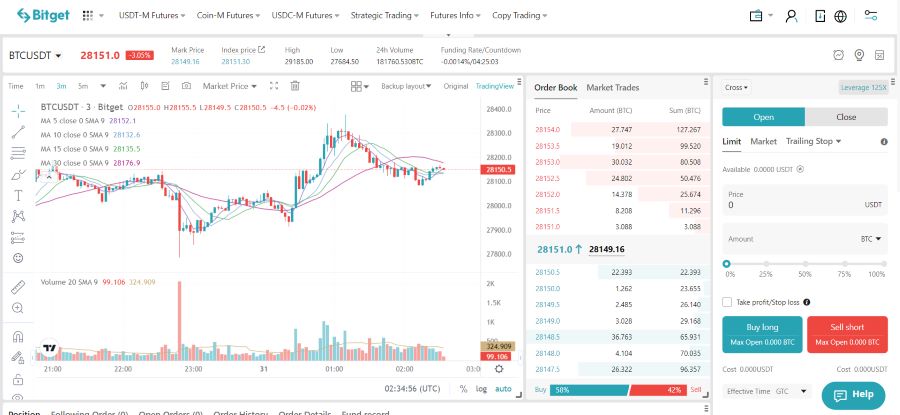

- Advanced Interface: Bitget’s web and mobile trading terminals feature TradingView-powered charting, multiple order types (limit, market, stop, OCO), and depth analytics. The platform supports custom layouts, multiple watchlists, and synchronized device settings for users who trade across desktop and mobile.

- API & Programmatic Access: REST and WebSocket APIs (plus FIX for institutions) enable market data streaming, order management, and account integrations. Popular bot tools connect via API for strategy automation.

-

Spot Trading:

- Asset Coverage: 600+ cryptocurrencies and 700+ trading pairs (figures vary by jurisdiction), covering large-cap assets, mid-caps, and emerging altcoin listings. Pairs are typically denominated in USDT, with select BTC and other quote options.

- Fees & Discounts: Base spot fees are competitive in the industry, with maker/taker discounts available via VIP tiers and token-based reductions using BGB, the platform’s native token.

-

Derivatives (Perpetual Futures):

- Contract Variety: 150+ perpetual pairs across USDT-M and coin-margined contracts, typically with leverage options up to 125x on select markets (note: high leverage is extremely risky; see risk warnings below).

- Risk Controls: Cross/isolated margin, auto-deleveraging (ADL), and optional features such as position TP/SL, trailing stops, and partial take-profit ladders. Liquidity is competitive, especially in high-volume BTC/ETH perpetuals.

-

Margin Trading & Funding:

- Cross and Isolated: Users can borrow assets to increase position size in spot and futures. Bitget provides real-time margin ratio metrics and liquidation warnings.

- Funding Rate Transparency: Standard funding rate mechanisms apply to perpetuals; traders can view historic and real-time funding data to manage carry and hedging strategies.

-

Copy Trading (Flagship Feature):

- Role-Based Structure: “Lead traders” share strategies while “followers” mirror trades automatically with flexible allocation rules.

- Analytics & Controls: Strategy dashboards expose PnL history, drawdown, win-rate, and risk metrics. Followers can cap allocations, set maximum slippage, and terminate copying at any time.

- Diverse Strategies: Futures-focused strategies dominate, but spot and grid-based strategies are also available for users seeking lower volatility.

-

Automated & Structured Products:

- Grid, DCA, and Rebalancing Bots: Built-in bots enable rules-based accumulation or market-making in spot and futures.

- Dual Investment & “Shark Fin” Products: Structured yield products offering variable returns within target price ranges; note that returns and capital risk vary with market conditions.

- Launchpad/Launchpool: Token sale and staking events for new projects (availability varies by region).

-

Bitget Earn and Staking:

- Flexible and Fixed Terms: Earn products include flexible savings, fixed-term yields, and occasional promotional rates.

- On-Exchange Staking: Users can stake select assets through Bitget Earn; yields depend on network rewards, liquidity conditions, and promotional campaigns.

-

On/Off-Ramps and P2P:

- Card, Bank, and Third-Party Providers: Localized fiat gateways available in many regions via partnerships; fees, KYC requirements, and limits vary by country.

- P2P Market: Peer-to-peer trading supports multiple currencies with escrow; traders must practice diligence and adhere to platform guidelines.

-

Web3 Integration (Bitget Wallet):

- Self-Custody Wallet: Multi-chain wallet for on-chain swaps, NFTs, and DeFi access. While separate from exchange custody, it complements Bitget's centralized services for users who want both CEX and Web3 functionality.

Security Measures

Security is core to any centralized cryptocurrency exchange. Bitget publicizes multiple safeguards to protect accounts and platform-level assets, alongside transparency commitments via Proof of Reserves.

-

Account Security:

- 2FA and Passkeys: Google Authenticator/SMS/Email 2FA and increasingly, passkey support for phishing-resistant login flows.

- Device & Session Controls: IP/device management and session history with one-click logout.

- Withdrawal Protection: Address allowlisting, anti-phishing codes, withdrawal cooldowns, and optional withdrawal confirmation layers.

- KYC & AML: Identity verification tiers are required for higher limits and certain products; enhanced monitoring is used to detect suspicious activity.

-

Platform Security:

- Custody Segregation: Hot/cold wallet architecture with multi-sig controls. Operational procedures aim to minimize hot wallet exposure.

- Infrastructure & Monitoring: Real-time risk engines for derivatives, DDoS mitigation, and internal alerting for anomalous withdrawals or trading spikes.

- Third-Party Testing: Regular penetration testing and security reviews are conducted; users should still apply best practices, including hardware keys and unique passwords.

-

Proof of Reserves (PoR) and Transparency:

- Merkle-Tree Auditing: Bitget publishes reserves snapshots and a public verification process for users to independently check inclusion in the Merkle tree.

- High Reserve Ratios: Bitget has reported reserve ratios exceeding 200% for major assets like BTC, ETH, USDT, and USDC during various snapshots; ratios can fluctuate over time.

- Protection Fund: A publicly disclosed protection fund (valued around hundreds of millions of USD) provides an additional buffer against extreme events; note that its scope and terms are set by the exchange and may change.

-

Historical Incidents & Disclosures:

- Track Record: As of recent years, Bitget has avoided widely reported, large-scale exchange hacks. It has, however, faced regulatory scrutiny (see compliance section) and occasional market-related incidents affecting specific users or strategies, as is common across the industry.

- Custodial Disclaimer: Assets held on Bitget are under Bitget's custody. Users should understand that exchange custody introduces counterparty risk. Long-term holders often diversify with self-custody where appropriate. Learn more about how to store crypto securely.

-

Risk Warnings:

- Derivatives: Trading derivatives, especially with high leverage, carries extreme risk and can result in the loss of your entire position rapidly.

- Custody: Assets held on Bitget are under Bitget’s custody; assess counterparty risk and consider self-custody for long-term storage.

- Scams/Phishing: Always verify domains, enable anti-phishing codes, and never share your 2FA or recovery codes with anyone. Review how to avoid crypto scams for additional protection.

User Experience

Bitget focuses on reducing friction for both advanced traders and first-time crypto users, with a strong emphasis on copy trading and education.

-

Interface & Mobile Apps:

- Clean, Configurable UI: Beginners can use simplified layouts, while pros can enable advanced modules, chart tools, and multi-panel workspaces.

- Mobile Parity: iOS and Android apps include core trading, copy trading, deposits/withdrawals, Earn, and portfolio views with performance metrics.

-

Social and Copy Trading:

- Discoverability: Rich filters (ROI, drawdown, duration, volatility, asset focus) help followers find compatible strategies.

- Transparency: Public leaderboards and sharable profiles encourage responsible competition, though users must still review risk metrics carefully.

-

Education & Research:

- Bitget Academy: Beginner-to-pro content on crypto trading, technical analysis, and risk management.

- Market Insights: Periodic research reports, token overviews, and exchange announcements keep users updated on listings, crypto airdrops, and product changes.

-

Customer Support:

- 24/7 Live Chat: Multilingual chat support and ticketing for account, KYC, and technical issues.

- Help Center: Guides for deposits, withdrawals, fee schedules, API keys, bots, and copy trading operations.

-

Onboarding & Compliance UX:

- KYC Flows: Streamlined identity checks with document upload and liveness detection. Users in certain regions may encounter stricter verification steps.

- Risk Reminders: Prompted warnings for leverage, margin calls, and structured products to reinforce informed decision-making.

Regulatory Compliance

Bitget operates globally but tailors its product availability to local regulations. The exchange emphasizes ongoing compliance efforts, including KYC expansion and Travel Rule integrations, while seeking registrations where available.

-

Entity and Registrations:

- Primary Registration: Bitget is registered in Seychelles and operates internationally.

- EU VASP Registrations: Bitget has pursued Virtual Asset Service Provider registrations in select EU jurisdictions (e.g., Lithuania and Poland), which support certain operational activities within the European market.

- Other Jurisdictions: Availability of specific features (derivatives, copy trading, Launchpad, Earn) varies and may be disabled in particular regions due to regulatory requirements.

-

Restrictions & Availability:

- United States: Bitget does not serve U.S. persons and typically restricts account creation or services for U.S. residents.

- Canada & Singapore: Access and product scope may be limited or subject to periodic changes as local rules evolve. Users in these markets should check the latest availability on the official site.

- Sanctioned Regions: Countries/regions under international sanctions or local prohibitions are generally blocked.

-

Compliance Controls:

- KYC/AML: Comprehensive KYC tiers, sanctions screening, and suspicious activity monitoring.

- Travel Rule Integrations: Information-sharing mechanisms for eligible transfers to meet FATF-aligned requirements.

- Disclosure & Risk Statements: Product-specific disclaimers for derivatives, staking, and structured products.

-

Regulatory Risk Warning:

- Users must verify the legality and availability of Bitget in their country. Regulations change frequently, and Bitget may modify, suspend, or discontinue products to maintain compliance.

Points to Consider

Before choosing any cryptocurrency exchange, evaluate the trade-offs, costs, and your own risk tolerance.

-

Fees and VIP Tiers:

- Spot & Derivatives: Base spot fees are competitive; futures fees typically favor makers with reduced rates. Larger traders can qualify for VIP tiers, while BGB-based discounts further lower costs. Always check the live fee schedule and consider your trading style (maker vs taker).

-

Copy Trading Risk:

- No Guaranteed Returns: Historical PnL does not guarantee future performance. Followers must review drawdown, strategy duration, and risk per trade. Start with small allocations, diversify across strategies, and set firm risk limits.

-

Leverage & Liquidation:

-

High-Leverage Danger: Even modest price moves can trigger liquidation. Use isolated margin for experimental positions, revisit leverage assumptions regularly, and set stop-loss/take-profit conditions before opening positions.

-

Custody vs Self-Custody:

-

Counterparty Considerations: While Bitget publishes Proof of Reserves and maintains a protection fund, exchange custody is not risk-free. For long-term holdings, consider self-custody and distribute assets across secure wallets. Understanding crypto volatility is also crucial for risk management.

-

-

Product Complexity:

- Structured Products & Earn: Yields depend on market conditions and may include risks such as impermanent loss, price-path dependency, or principal risk. Understand payoff diagrams and lock-up terms before allocating capital.

Conclusion

Bitget stands out as a derivatives-focused cryptocurrency exchange with one of the industry’s most active copy-trading ecosystems, competitive fees, and broad asset coverage. The platform balances advanced tooling—APIs, bots, grid/DCA automation—with approachable UX, educational content, and strong product breadth from spot to structured Earn products. Security-wise, its Proof of Reserves program and protection fund enhance transparency and resilience, though users should still consider the inherent risks of exchange custody. Regulatory access varies by country, and U.S. persons are restricted; prospective users must confirm local availability and the latest product scope.

Ideal for active traders who value copy trading, futures liquidity, and an integrated Earn suite, Bitget also serves newer users who prefer guided strategies—provided they adopt conservative allocations and learn risk controls. Final verdict: Bitget offers robust copy trading and derivatives depth at competitive fees, but users must weigh leverage risks, regional restrictions, and the trade-offs of exchange custody. For those new to crypto trading, starting with small allocations and focusing on education remains essential.

Visit Exchange

Learn more about this cryptocurrency exchange platform

We may earn a commission at no extra cost to you. This is not financial advice. Cryptocurrency exchanges involve significant risks, including potential loss of all funds. Always verify the platform is legal in your jurisdiction and never invest more than you can afford to lose.

Explore other platforms on our Exchanges page or learn more about exchanges and brokers in general in our guide: Understanding Crypto Exchanges.