*Disclaimer: The information provided here is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves risks, so please DYOR. For beginners, check out our Beginners Guides to learn more.

Upbit

Upbit: Korea’s Dominant Fiat On-Ramp for Altcoin Trading

Upbit is a South Korea–headquartered cryptocurrency exchange launched in 2017 that has grown into one of the world’s largest spot markets by volume, particularly for KRW pairs. Best known for its deep order books in Korean fiat markets and conservative compliance posture, Upbit has become the primary gateway for Korean retail investors to access digital assets.

Headquartered in Seoul and operated by Dunamu, Upbit differentiates itself with strong banking integrations for KRW deposits/withdrawals, a broad selection of altcoins listed against KRW, BTC, and USDT, and a restrained product set focused on spot crypto trading over leveraged derivatives. It serves both domestic users and an international audience via its global platform, with a reputation for solid operational controls and swift incident response.

Core Services

Upbit’s product scope centers on spot crypto trading and fiat on/off-ramps in South Korea, with select services for international users.

-

Trading Platform:

- Upbit runs a robust spot market with 200+ cryptocurrencies and 300+ trading pairs (availability varies by jurisdiction). Major assets like Bitcoin and Ethereum trade in KRW, BTC, and USDT markets.

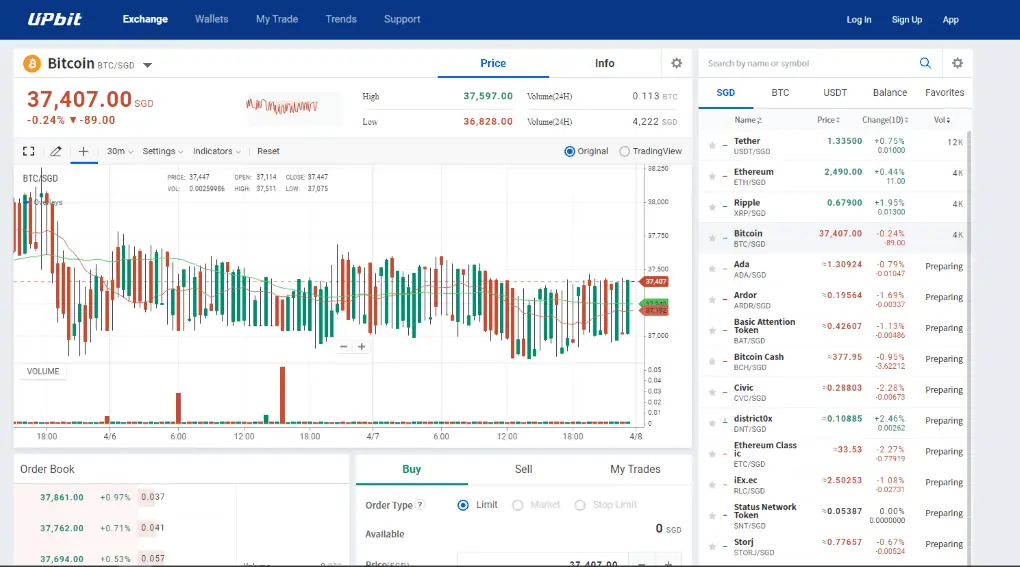

- The interface supports advanced charting (TradingView integration is common across leading exchanges) and core order types—market, limit, and conditional triggers—appropriate for both beginners and seasoned traders.

-

Spot Markets and Liquidity:

- Upbit's KRW books are among the deepest in the region. This depth can translate into tighter spreads for popular pairs, with competitive price discovery during local market hours.

-

Fiat On/Off-Ramps (KRW):

- In South Korea, Upbit offers integrated KRW deposits and withdrawals via partner banking. Foreigners generally need local residency and a linked bank account to access KRW rails. Non-Korean users can still access crypto-to-crypto markets (subject to local restrictions), but fiat functionality may be unavailable outside Korea.

-

Altcoin Coverage:

- Upbit is recognized for broad asset coverage, including smaller-cap tokens that attract active traders during altcoin cycles. As always, altcoins can be volatile; review fundamentals and stay vigilant about scams.

-

Staking and Earn (Selective):

- Upbit has intermittently offered staking or earn-style programs for select proof-of-stake assets. Availability is region- and asset-specific and can change with regulation.

-

NFT and Web3 Touchpoints:

- Upbit has experimented with NFT-related experiences across its ecosystem, though NFT availability, formats, and promotional events can be periodic.

-

Education and Safety Emphasis:

- Upbit's investor-protection messaging encourages safer self-custody for long-term storage. If you don't actively trade, consider a hardware or non-custodial wallet. Learn more about how to store crypto securely.

-

Comparative Positioning:

- Upbit competes on spot-market liquidity and compliance, especially in KRW markets, rather than on derivatives breadth. For users prioritizing global derivatives selection, see alternatives like Binance, OKX, or Bybit. For a more regulated U.S. on-ramp, compare Coinbase or Gemini; for a balanced spot-derivatives mix with a strong compliance posture, see Kraken; for altcoin breadth, KuCoin is a common comparison.

Security Measures

Upbit's security program combines account-level protections, operational controls, and measured disclosure. The exchange's approach was notably stress-tested during a 2019 incident involving a hot wallet, after which the firm reinforced blockchain protections and compensated users.

-

Account Security:

- Two-Factor Authentication (2FA): Upbit requires strong 2FA for logins and withdrawals. Combine app-based 2FA with strong, unique passwords and consider passkey support where available.

- Withdrawal Safeguards: Address whitelisting, withdrawal delays for newly added addresses, and anti-phishing codes are commonly enforced.

-

Platform Security and Custody Controls:

- Cold vs. Hot Wallets: The majority of client assets are typically stored in cold wallets, with only a small operational float in hot wallets.

- Monitoring and Segmentation: Suspicious activity monitoring, risk-based controls, and wallet segregation are standard.

- Proof of Reserves Context: While some exchanges publish attestations, methodologies vary.

-

Historical Incidents and Response:

- In November 2019, approximately 342,000 ETH were moved from an Upbit hot wallet in an incident widely covered in crypto media. Upbit compensated the shortfall and restructured wallet operations afterward. Since then, there have been no comparable incidents of the same magnitude reported publicly.

-

Custodial Disclaimer:

- Assets held on Upbit are under Upbit's custody. If the platform is compromised, experiences downtime, or faces regulatory freezes, access to your funds may be affected. Consider off-exchange storage where appropriate.

-

Derivatives Risk Warning:

- Trading derivatives, especially with high leverage, carries extreme risk and is not suitable for most investors. While Upbit focuses on spot, users exploring leveraged products elsewhere should first understand the risks involved.

User Experience

Upbit’s UX is designed for high-frequency spot trading with a clean interface, extensive KRW support, and mobile-first usage patterns common in Korea.

-

Interface and Performance:

- Web and Mobile Apps: Upbit offers real-time order book updates, fast order execution, and responsive mobile apps.

- Charting and Tools: TradingView-style charting, drawing tools, and technical indicators are available. Market-depth and time-and-sales data are easily accessible.

- Order Types: Market, limit, and stop-like triggers cover most retail needs; advanced quant tools are comparatively limited, which aligns with Upbit's non-derivatives focus.

-

Onboarding and KYC:

- Identity Verification: KYC is required for fiat access in Korea under VASP regulations. KYC levels can influence deposit/withdrawal limits and feature availability.

-

Educational Content and Alerts:

- Upbit periodically publishes notices on listings, delistings, and risk warnings. Users should subscribe to official channels and scrutinize tokens' fundamentals, especially during speculative phases.

-

Customer Support:

- Help Center and Ticketing: Support is handled primarily through web tickets and in-app forms; language support prioritizes Korean, with English available for global services.

- Response Expectations: Response times vary based on market conditions and ticket volume. Keep security-sensitive requests (e.g., account recovery) as detailed as possible and monitor official announcements.

Regulatory Compliance

Upbit operates within South Korea’s evolving digital asset regime and leverages separate entities for select international markets.

-

South Korea (Core Market):

- VASP Registration and ISMS: Upbit was among the first Korean exchanges to secure Information Security Management System (ISMS) certification and to register as a Virtual Asset Service Provider (VASP) with the Korea Financial Intelligence Unit (KoFIU), meeting requirements like real-name bank accounts.

- Travel Rule: Upbit complies with the Travel Rule for transfers above certain thresholds using industry-standard solutions; this may restrict withdrawals to non-compliant platforms.

- Product Scope: The exchange places emphasis on spot over leveraged derivatives for retail users in Korea, reflecting local guidelines.

-

International Operations:

- Local Frameworks: Upbit has operated regionally (e.g., Singapore, Indonesia) via local entities subject to local laws and licensing regimes. Specific permissions differ by jurisdiction and can change as rules evolve.

- Availability and Geo-Restrictions: Features, asset lists, and fiat rails differ by country. Users must verify the legality and availability of Upbit in their country before opening an account. If Upbit is not locally supported, compare with alternatives like Coinbase for U.S.-regulated access, or OKX and Binance for broader global coverage.

-

Regulatory Risk Warning:

- Rules around digital assets are in flux worldwide. New guidance can affect listings, stablecoin availability, and withdrawal limits. Users must verify the legality and availability of Upbit in their country before using the platform.

Points to Consider

Before you choose Upbit for crypto trading and digital assets, weigh these factors carefully.

-

Fees and Market Choice:

- Trading Fees: Upbit's fees vary by market; KRW pairs tend to be lower than BTC/USDT pairs. Always review the fee schedule, including deposit/withdrawal fees and network costs.

-

KRW Banking Requirements:

-

Local Residency Needs: Access to KRW deposit/withdrawal typically requires a Korean bank account and residency-based verification. International users may be limited to crypto-to-crypto trading.

-

No Emphasis on Derivatives:

-

Spot-First Model: If you require perpetuals, options, or advanced hedging, Upbit may not meet your needs. Consider exchanges known for derivatives—e.g., Binance or OKX —but study the risks involved.

-

-

Listing Turnover and Asset Risk:

- Delistings Happen: Upbit periodically reevaluates listings for compliance and liquidity reasons; tokens can be suspended or removed. Manage position sizing and keep a diversified approach. Review how to avoid crypto scams and understand fundamentals through DYOR, not just narratives.

-

Custody and Self-Custody Trade-Offs:

- Custodial Risk: Exchanges concentrate risk. If you're holding long-term, consider a non-custodial setup. Learn best practices for safe storage in how to store crypto.

Conclusion

Upbit's core strengths lie in its KRW on-ramp, deep spot liquidity, and conservative product scope aligned with South Korean regulations. It's particularly compelling for users who want a reliable spot-focused cryptocurrency exchange with strong fiat connectivity in Korea and a wide range of listed digital assets. The trade-off is limited derivatives functionality, varying access for non-Korean residents, and occasional listing churn tied to compliance reviews.

Who is Upbit best for? Korean residents who want a robust KRW gateway; international users who primarily trade spot and value compliance-first operations; and investors who prefer an uncluttered product set that emphasizes security and regulation over high-leverage features. If you require global derivatives coverage or broader financial products, compare with Kraken, OKX, or Binance; if you want a regulated U.S. on-ramp, Coinbase and Gemini may fit better. Final verdict: Upbit is a top-tier spot platform with standout KRW liquidity and compliance rigor, but limited derivatives and regional constraints may push power users to supplement with a second exchange.

Visit Exchange

Learn more about this cryptocurrency exchange platform

We may earn a commission at no extra cost to you. This is not financial advice. Cryptocurrency exchanges involve significant risks, including potential loss of all funds. Always verify the platform is legal in your jurisdiction and never invest more than you can afford to lose.

Explore other platforms on our Exchanges page or learn more about exchanges and brokers in general in our guide: Understanding Crypto Exchanges.