*Disclaimer: The information provided here is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves risks, so please DYOR. For beginners, check out our Beginners Guides to learn more.

HTX

HTX: A Global, Altcoin-Rich Cryptocurrency Exchange Evolving from Huobi

HTX (formerly Huobi Global) is a veteran cryptocurrency exchange founded in 2013 by Leon Li. Now headquartered in the Seychelles with a globally distributed team, HTX positions itself as a full‑stack trading venue for digital assets—spanning spot, margin, and high‑leverage derivatives—alongside yield products and token launch events. The exchange is known for deep markets in major pairs and broad access to emerging altcoins, plus an active community shaped in part by strategic involvement from TRON founder Justin Sun beginning in 2022. Over a decade in, HTX remains an important venue for crypto trading, particularly in Asia and emerging markets, while continuing to refine its security, compliance posture, and product lineup.

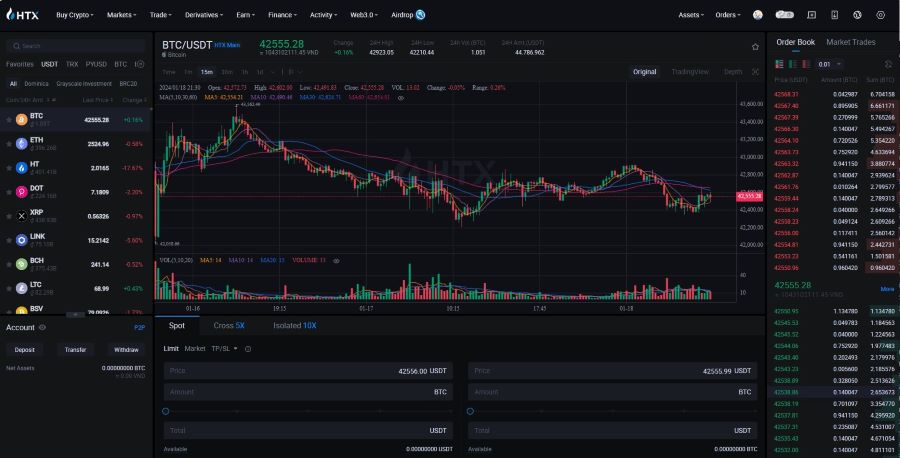

Core Trading Platform

HTX’s core appeal is breadth: hundreds of cryptocurrencies, extensive trading pairs, and a layered ecosystem for both beginners and advanced traders.

-

Spot Trading: Access to 500+ digital assets and 1,000+ pairs, including majors like Bitcoin and Ethereum, plus a long tail of DeFi, GameFi, and infrastructure tokens. Order types include market, limit, stop‑limit, and trigger orders, plus advanced modes such as one‑cancels‑the‑other (OCO) on web and mobile. The base maker/taker fee typically starts around 0.20% and scales down with volume tiers; holding the exchange token (HT) or joining VIP tiers can further reduce fees.

-

Derivatives (Perpetuals and Futures): USDT‑margined and coin‑margined perpetual swaps and dated futures on leading assets, with configurable leverage up to 100x–200x on selected contracts. HTX offers risk controls (initial/maintenance margin tiers, auto‑deleverage indicators), plus partial TP/SL, reduce‑only, and post‑only flags for precision entries. While leverage can amplify results, it also magnifies losses and liquidation risk; many traders complement entries with sentiment tools like the Fear and Greed Index to gauge market extremes.

-

Margin Trading: Cross and isolated margin on a large subset of spot markets, commonly up to 5x–10x leverage with dynamic borrowing rates. HTX incorporates real‑time health ratios and forced deleveraging mechanisms to contain systemic risk.

-

Earn (Staking, Savings, Structured Products): Flexible and fixed “Earn” programs on major PoS assets and stablecoins. Offers can include on‑chain staking, savings vaults, and structured yield products such as dual‑investment and shark‑fin notes. For those new to yield, it helps to understand how staking works at a protocol level via The Ultimate Beginner’s Guide to Crypto Staking, and to remember that exchange‑custodied yields add platform risk on top of asset risk.

-

Token Listings and Launch Events: Periodic listing campaigns, Launchpool/Primepool‑style events, and community airdrops for new projects. These can be attractive for early access but carry volatility and project risk inherent to new token economies; context on What is DeFi (Decentralized Finance)? can be useful as many new listings tie into DeFi narratives.

-

OTC and P2P Fiat Access: Regional P2P desks connect buyers and sellers for popular fiat currencies using escrow. Availability and supported rails vary by country and compliance requirements.

-

API and Institutional Tools: REST and WebSocket APIs, sub‑accounts, and advanced permissions support market‑making, high‑frequency strategies, and operational segregation for teams. Rate limits and dedicated VIP account managers are available at higher tiers.

-

Exchange Token (HT): Historically used for trading fee discounts, VIP tiers, and occasional ecosystem perks. Token mechanics and branding have evolved with the HTX rebrand; benefits are programmatic and subject to change, so reviewing the current fee schedule and token utility page before committing is wise.

Security Measures

Security on an exchange is about layered defenses across accounts, infrastructure, and operational processes. HTX blends standard controls with post‑incident changes learned over time.

-

Account Protections:

- Two‑Factor Authentication (2FA): TOTP and SMS options, with 2FA required for sign‑ins, trading, and withdrawals.

- Security Keys and Anti‑Phishing Codes: U2F keys enhance protection against phishing; anti‑phishing codes help authenticate official emails.

- Withdrawal Whitelists and Time Locks: Address allowlisting, withdrawal freezing after credential changes, and optional time locks reduce the risk of unauthorized outflows.

-

Platform‑Level Controls:

- Cold and Hot Wallet Segregation: The majority of funds are maintained in cold storage with multi‑signature controls; hot wallets are limited for operational liquidity.

- Real‑Time Risk Systems: Position monitoring, liquidation throttles, and circuit breakers on derivatives to mitigate cascading risk during extreme volatility.

- Bug Bounties and Incident Response: Public bug bounty programs and a security team tasked with on‑chain analytics and rapid response.

-

Historical Incidents (Contextualized):

- In September 2023, an HTX hot wallet was exploited for roughly $8M. A bounty and negotiations reportedly led to the return of funds.

- In November 2023, the HECO bridge (associated with the broader Sun‑affiliated ecosystem) suffered an exploit reportedly exceeding $90M. HTX temporarily paused deposits and withdrawals during assessment.

Incidents of this scale are rare but material; they underline the importance of minimizing exchange custody for long‑term holdings and learning how to safely store your cryptocurrency in self‑custody wallets.

-

Proof of Reserves and Transparency: HTX has published asset reserve snapshots and reserve‑ratio disclosures, periodically sharing wallet proofs. Methodologies and scope can change, and liabilities are harder to attest on‑chain; treat any PoR as one data point rather than a guarantee.

-

Operational Hygiene: Strong password policies, withdrawal reminders, and explicit device management features help users reduce personal risk. For unfamiliar DMs or unsolicited offers around listings or airdrops, it’s wise to revisit principles from Crypto Scams: How to Spot and Avoid Them.

User Experience

HTX aims to bridge the needs of casual users and professional traders without overwhelming either group.

-

Interface and Charting:

- Standard and Pro Modes: A simplified buy/sell interface and a full‑featured terminal with depth charts, multiple timeframes, indicators, and custom layouts.

- Order Management: Advanced order types, iceberg and post‑only flags, order execution feedback, and PnL tracking for derivatives.

-

Mobile Apps (iOS/Android):

- Unified Experience: Perform KYC, funding, P2P purchases, and full order management on mobile.

- Security: Biometric login, withdrawal safeguards, and device authorization flows.

-

Onboarding and Education:

- Guides and Walkthroughs: Step‑by‑step KYC, deposit tutorials, and futures primers reduce friction.

- Research Portal: Market briefings, listing calendars, and token pages with fundamentals and risk disclosures. For context on tradeoffs between activity and patience, many users weigh Crypto Trading vs. Holding as they set their strategy.

-

Support and Service Levels:

- 24/7 Live Chat and Tickets: Multilingual support, typically with triage by product (Spot, Contracts, P2P).

- VIP Coverage: Higher‑tier clients receive dedicated account managers, custom fee schedules, and faster operational support.

-

Market Breadth and Liquidity:

- Majors: Deep liquidity on BTC, ETH, and stablecoin pairs.

- Altcoins: Broad coverage across mid‑cap and long‑tail assets; spreads and depth can vary significantly on lesser‑traded tokens, a consideration for slippage.

Global Operations and Regulatory Landscape

HTX operates primarily as an offshore, global cryptocurrency exchange with region‑specific controls and products.

-

Entity and Jurisdictions: The core entity is registered in the Seychelles, with affiliated operational hubs in Asia and the Middle East. Availability of features (especially derivatives, margin, and P2P) varies by country and changes over time.

-

Licensing and Registrations: HTX has pursued registrations where feasible, but the platform’s model remains globally oriented rather than domestically (e.g., US) focused. In certain markets, compliant access is constrained to spot‑only products or to non‑derivatives offerings. For those weighing venue types and protections, it helps to understand the spectrum in Understanding Crypto Exchanges.

-

Restricted Regions: Users from the United States and a number of other jurisdictions may face outright inaccessibility or restricted product sets (notably derivatives). Always confirm permitted use during signup; HTX enforces KYC for most services and enhanced verification for leveraged products.

-

Comparative Landscape:

-

Marketing and Disclosures: Risk warnings are prominent on derivatives pages; fees, funding rates, and contract specs are published in product documentation. As with any offshore exchange, policy changes can be faster‑moving than in strictly domestic venues—review change logs and official announcements regularly.

Founders and Historical Context

HTX (formerly Huobi Global) was founded in 2013 by Leon Li, originally operating as a Bitcoin exchange in China before expanding globally.

- Origins (2013–2017): Founded in China by Leon Li, Huobi quickly became a leading Asian exchange, focusing on liquidity and operational reliability.

- Globalization (2018–2021): Expansion into Singapore and other hubs, development of derivatives, and institutional services.

- Rebrand and Governance (2022–2024): Post‑2022 ownership shifts and the strategic involvement of Justin Sun coincided with a rebrand to HTX in 2023. The exchange matured its product suite, added more Earn/structured products, and refined PoR communications in response to broader industry custody concerns.

Brand and Token Utility

-

HT Token (Legacy Utility): Historically provided fee discounts, VIP tiering, and occasional campaign perks. The rebrand to HTX accompanied updates in branding rather than an immediate overhaul of token mechanics, but users should verify the current discount model and any staking or burn programs tied to HT.

-

Listings and Community: HTX’s brand has been tied to frequent listings and regional marketing events. Launch campaigns and trading competitions can be attractive for active users but deserve careful evaluation of fundamentals and liquidity risks—especially for newer DeFi‑adjacent tokens where narratives move fast, as explained in What is DeFi (Decentralized Finance)?.

Points to Consider

-

Fees and VIP Tiers:

- Base spot fees around 0.20% can be meaningfully reduced with volume tiers and HT holdings; derivatives often start near 0.02% maker / 0.05% taker. Confirm the current fee schedule and whether your trading profile justifies VIP deposits or token thresholds.

-

Leverage Discipline:

- Derivatives on HTX offer up to 100x–200x on select contracts. While that’s competitive, it increases liquidation risk and requires robust risk management, position sizing, and an understanding of funding mechanics. Using tools like the Fear and Greed Index can help contextualize market sentiment.

-

Liquidity by Market Cap:

-

Custody Approach:

- Past incidents (e.g., 2023 hot wallet and bridge exploits) underscore the importance of storing long‑term funds off‑exchange. Keep only operational capital on HTX and route cold reserves to self‑custody as outlined in How to Safely Store Your Cryptocurrency.

-

Product Complexity and Education:

- Earn, dual‑investment, and structured notes can be non‑linear and path‑dependent. If you mainly accumulate majors over time, consider whether a simpler approach aligns better with your plan as discussed in Crypto Trading vs. Holding.

Conclusion

HTX is a long‑standing global cryptocurrency exchange with extensive market coverage, competitive derivatives, and a deep catalog of altcoins and yield products. It stands out for breadth, active campaigns, and pro‑grade tooling, but it also carries the trade‑offs of an offshore venue: varying product availability by region, evolving disclosures, and a security track record that demands prudent custody habits. For active traders comfortable with derivatives, multi‑market rotation, and dynamic fee tiers, HTX is a capable, feature‑rich platform. For long‑term allocators or users prioritizing domestic compliance footprints, comparing alternatives and using self‑custody for reserves is prudent. Overall verdict: a versatile, liquidity‑rich venue for experienced users who value breadth and speed—best approached with disciplined risk management and clear custody practices.

If you’re new to centralized venues, it’s helpful to ground your expectations with Understanding Crypto Exchanges and foundational knowledge of assets like Bitcoin and Ethereum before diving into advanced products or emerging DeFi tokens.

Visit Exchange

Learn more about this cryptocurrency exchange platform

We may earn a commission at no extra cost to you. This is not financial advice. Cryptocurrency exchanges involve significant risks, including potential loss of all funds. Always verify the platform is legal in your jurisdiction and never invest more than you can afford to lose.

Explore other platforms on our Exchanges page or learn more about exchanges and brokers in general in our guide: Understanding Crypto Exchanges.