*Disclaimer: The information provided here is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves risks, so please DYOR. For beginners, check out our Beginners Guides to learn more.

Bitfinex

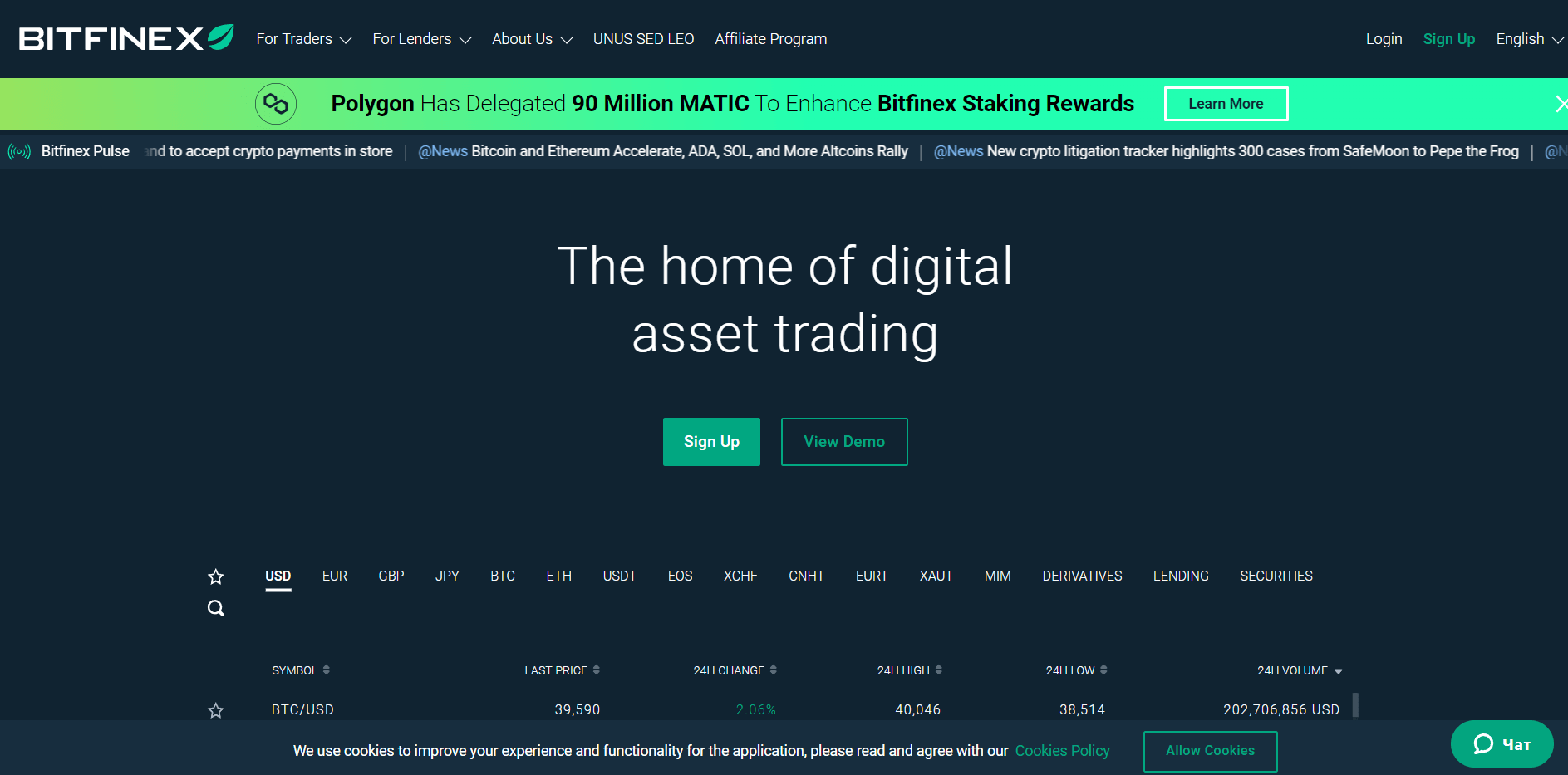

Bitfinex: A Veteran Global Cryptocurrency Exchange for Professionals

Founded in 2012, Bitfinex is one of the longest-running centralized cryptocurrency exchanges in the industry. Operated by iFinex Inc., the platform has historically catered to professional traders thanks to deep order books in major pairs, advanced order types, and a robust API suite. While its corporate structure has ties to the British Virgin Islands and operations historically associated with Hong Kong, Bitfinex has developed a network of entities for specific services (including tokenized securities) as it expanded globally. Its longevity, liquidity in flagship markets like Bitcoin (BTC/USD) and Ethereum (ETH/USD), and sophisticated trading stack make Bitfinex a notable venue for advanced crypto trading on digital assets.

Core Trading Platform and Services

Bitfinex focuses on a feature-rich trading experience with a broad set of markets, margin capabilities, a P2P funding market, and derivatives offered in permitted jurisdictions. The platform is purpose-built for active traders who value reliable execution, low-latency APIs, and customizability.

- Spot Trading: Access 180+ cryptocurrencies and 400+ trading pairs, with deep liquidity in majors (e.g., BTC, ETH) and a curated selection of altcoins. The interface supports TradingView-style charting, custom layouts, and 100+ indicators.

- Margin Trading (up to 10x): Experienced users can trade on margin with configurable leverage settings. Margin availability depends on pair liquidity and market conditions. While leverage can amplify profits, it equally magnifies losses; prudent risk controls are essential.

- Funding Market (P2P Lending): Unique among major exchanges, Bitfinex’s P2P funding market lets users lend or borrow funds to support margin positions. Lenders can set rates and durations; borrowers can source liquidity dynamically. Rates are variable and can move quickly in volatile conditions.

- Derivatives (Perpetual Swaps): In eligible jurisdictions, Bitfinex Derivatives offers perpetual contracts with competitive funding mechanics and up to 100x leverage on select markets. Sophisticated position management tools, cross/isolated margin, and portfolio margin (where available) can help optimize capital efficiency. Derivatives are high risk and can lead to rapid losses if unmanaged.

- OTC Desk: For institutions and high-net-worth individuals, an OTC desk facilitates large block trades (commonly from $50,000+) with minimal market impact and dedicated settlement workflows.

- Staking Services: Bitfinex provides staking on select proof-of-stake assets with variable rewards. Availability, yields, and supported assets change over time and by jurisdiction. As with any custodial staking, consider counterparty and lockup constraints relative to self-custody options.

- Borrowing (Bitfinex Borrow): Crypto-backed loans provide flexible liquidity using digital assets as collateral. Rates are market-driven, and liquidation thresholds should be monitored closely when collateral is volatile.

- Advanced Order Types: Beyond limit/market orders, Bitfinex supports OCO, trailing stops, FOK/IOC, hidden and post-only orders, and “Scaled Orders” to algorithmically distribute entries/exits across price bands.

- API and Automation: REST and WebSocket APIs are optimized for low-latency trading, order book streaming, and account management. The open-source “Honey Framework” enables custom strategies and execution logic for quants and power users.

- Mobile Apps: Feature-rich iOS and Android apps mirror the desktop experience with spot, margin, derivatives (where available), and funding.

Security Measures

Bitfinex has endured and evolved through some of crypto’s most formative security chapters, implementing layered defenses across custody and account protection. The platform emphasizes operational security and user controls.

- Cold Storage and Wallet Architecture: The exchange states that 99%+ of customer assets are held in cold storage, with limited hot-wallet balances to support withdrawals. A multi-signature governance model and segregation of duties reduce single points of failure.

- Account Security Controls: Users can enable 2FA via TOTP and FIDO2/U2F security keys, set withdrawal address whitelists, configure anti-phishing codes, and review active sessions and IPs. PGP email encryption is supported for secure communication.

- Withdrawal Safeguards: Manual checks, velocity limits, and IP/device fingerprints help flag anomalies. Address whitelisting and optional withdrawal delays add situational friction for sensitive actions.

- Network and App Security: DDoS protection, rate limiting, and hardened API gateways mitigate common attack vectors. Bitfinex runs ongoing vulnerability assessments and maintains a bug bounty to encourage responsible disclosure.

- Historical Incidents: In August 2016, Bitfinex suffered a breach resulting in the loss of ~119,756 BTC. The exchange socialized losses via BFX tokens and later redeemed them, ultimately making customers whole over time. In 2022, U.S. authorities recovered a significant portion of the stolen BTC and arrested suspects. Past incidents underscore why layered defenses and user-side security hygiene remain critical. For comprehensive security best practices, review How to Avoid Crypto Scams.

As with any custodial platform, users should evaluate what portion of their long-term holdings they keep on an exchange versus in self-custody solutions. For guidance on secure storage practices, see How to Store Crypto. Shorter-term trading balances are generally more appropriate for custodial storage than long-term reserves.

User Experience

Bitfinex’s interface is designed for professional-grade workstations without sacrificing clarity. While beginners can learn the ropes, the platform shines when traders leverage its advanced tooling.

- Interface and Customization: Modular panels, detachable charts, multiple watchlists, and rich order entry forms create a workspace suited for high-activity trading. Keyboard shortcuts and rapid order placement help reduce friction.

- Charting and Analytics: Integrated advanced charting provides deep historical data, multiple timeframes, custom indicators, and drawing tools. Level 2 order books and aggregated depth views assist with liquidity analysis.

- Portfolio and Risk Tools: Real-time PnL, margin utilization, and funding exposure views help traders monitor risk. Portfolio margin (where available) can optimize capital usage but also demands sophisticated risk management.

- Education and Research: Bitfinex Learn and in-platform tips offer primers on trading, staking, security practices, and platform mechanics. Market insights and occasional reports help contextualize macro developments.

- Customer Support: Support is delivered through a ticket system and detailed knowledge base documentation. Response times vary by load and issue complexity, with priority support available for institutional accounts.

Regulatory Compliance and Global Operations

Compliance at Bitfinex is nuanced due to its history, corporate structure, and product mix. Availability and features differ significantly by jurisdiction.

- Corporate Structure: Bitfinex is operated by iFinex Inc., historically associated with the British Virgin Islands, and leverages affiliated entities to offer particular services (e.g., derivatives and tokenized securities) to applicable markets.

- Licensing and Registrations: While Bitfinex does not operate as a licensed money services business in certain regions, it has developed licensed tokenized securities offerings through Bitfinex Securities entities—first in the Astana International Financial Centre (AIFC) and subsequently in El Salvador—reflecting a targeted approach to regulated products.

- Jurisdictional Restrictions: Bitfinex is not available to U.S. persons and restricts access from sanctioned jurisdictions and regions with specific regulatory prohibitions. Derivatives availability is additionally gated by regional policies and user verification status. For U.S. users seeking compliant alternatives, consider exchanges like Coinbase or Kraken that operate under U.S. regulatory frameworks.

- Compliance Controls: The exchange implements KYC/AML procedures aligned with product tiers. Advanced features like derivatives and higher withdrawal thresholds generally require full verification. Transaction monitoring and on-chain analytics support compliance operations.

- Regulatory Matters and Disclosures: In 2021, Bitfinex and Tether's parent iFinex settled with the New York Attorney General for $18.5 million, agreeing to enhanced transparency commitments and ceasing business with New York residents. This history is notable when evaluating counterparty and regulatory risk profiles.

Founders and Historical Context

Bitfinex was founded in 2012 by Raphael Nicolle and Giancarlo Devasini, initially operating as a peer-to-peer Bitcoin exchange before evolving into a full-featured trading platform.

- Origins (2012): Bitfinex was created by Raphael Nicolle, evolving from an early Bitcoin margin trading platform into a full-fledged exchange. Over time, leadership roles have included figures such as Giancarlo Devasini and Paolo Ardoino (who has served in key executive roles).

- Early Innovation: Bitfinex helped pioneer exchange-based margin trading and a P2P funding market, features that later influenced industry norms. The platform became known for deep liquidity and professional tooling.

- 2016 Breach and Recovery: The 2016 hack was a watershed moment. Bitfinex issued “BFX” tokens to affected customers and later redeemed them at face value, an unusual recovery path in the industry at that time.

- 2022 Recovery and Legal Developments: U.S. authorities recovered a large portion of stolen BTC, with the exchange stating it would use proceeds from any recovery (net of costs) to buy back and burn its UNUS SED LEO token per its whitepaper commitments.

Token Utility: UNUS SED LEO

- LEO Token Purpose: UNUS SED LEO (LEO) is the iFinex ecosystem token, launched in 2019. Holding LEO can reduce maker/taker fees and provide discounts on lending and derivatives fees (where available). The scale of benefits depends on a user’s LEO holdings and 30-day volume.

- Buyback and Burn: iFinex commits a portion of its revenues and any net recovered proceeds from the 2016 incident to buying back and burning LEO. This mechanism seeks to align token economics with platform performance and extraordinary recoveries.

- Considerations: LEO’s utility is tied to actual usage of Bitfinex services and changes as fee schedules evolve. Token prices are volatile, and fee-benefit calculations should be weighed against portfolio and trading frequency.

Proof of Reserves and Transparency

- Wallet Transparency: Bitfinex has historically published select wallet addresses and maintained public communication regarding on-chain activity of notable addresses. While helpful, address publication alone is not a full proof-of-reserves solution.

- Attestations and Methods: The exchange has discussed or implemented various transparency measures over time, including Merkle tree-based approaches. Users should review current disclosures to understand coverage, scope (assets vs. liabilities), and third-party involvement.

- Industry Context: Proof-of-reserves remains an evolving practice across the cryptocurrency exchange sector. Robust implementations typically combine cryptographic proofs, third-party oversight, and frequent updates, with liabilities included to give users a complete picture.

Fees and Liquidity

- Spot Fees: The standard schedule starts around 0.1% maker and 0.2% taker, with tiered discounts based on 30-day volume. LEO holdings can further reduce fees.

- Derivatives Fees: Derivatives markets have their own maker/taker and funding fee schedules. Funding rates change continuously based on long/short imbalances.

- Funding Market Rates: P2P lending rates are variable; during high volatility, rates can spike and availability can tighten.

- Liquidity Profile: Bitfinex is renowned for deep liquidity in core pairs like BTC/USD and ETH/USD, with tight spreads and large resting orders attractive to sophisticated traders and institutions.

Points to Consider

- Fees and Discounts: If you are an active trader, model your expected 30-day volume and potential LEO holdings to quantify fee savings. For infrequent traders, fee optimization via token holdings may be less compelling.

- Product Complexity: Margin, funding markets, and derivatives require solid risk management. Use conservative leverage, plan for slippage during crypto volatility, and set strict liquidation buffers.

- Jurisdictional Access: Availability depends on your location and verification tier. U.S. persons and residents of certain regions cannot use Bitfinex, especially for derivatives. Check eligibility before onboarding.

- Custody Strategy: For long-term holdings, assess whether to keep assets on-exchange or in self-custody. Many traders maintain minimal balances for active strategies and sweep profits to external wallets. Learn more about secure storage options in How to Store Crypto.

- Platform Fit: Bitfinex shines for professionals needing deep liquidity and advanced tooling. Beginners can use it, but the learning curve is steeper than simplified retail apps. New users may benefit from starting with Crypto for Beginners before diving into advanced trading features.

Conclusion

Bitfinex stands out as a veteran cryptocurrency exchange purpose-built for professional traders who value deep liquidity, advanced order types, and refined API access. Its strengths include a mature P2P funding market, curated listings with depth in majors, and a comprehensive trading stack that scales from spot to derivatives (in eligible regions). Balancing those advantages are its complex product set, past security and regulatory headlines, and jurisdictional limitations. For experienced market participants and institutions, Bitfinex remains a formidable venue; for newcomers seeking simplicity, the platform may feel dense until skills catch up. If you're new to cryptocurrency exchanges, start with Understanding Crypto Exchanges to build foundational knowledge.

Visit Exchange

Learn more about this cryptocurrency exchange platform

We may earn a commission at no extra cost to you. This is not financial advice. Cryptocurrency exchanges involve significant risks, including potential loss of all funds. Always verify the platform is legal in your jurisdiction and never invest more than you can afford to lose.

Explore other platforms on our Exchanges page or learn more about exchanges and brokers in general in our guide: Understanding Crypto Exchanges.