What Is a Bear Market in Crypto?

Understanding Crypto Bear Markets: A Complete Guide

If you've watched your portfolio swing from green to deep red in weeks, you're not alone. Crypto bear markets can feel relentless—prices fall, sentiment sours, and confidence vanishes. Understanding what a bear market is, how it forms, and how to navigate one can turn panic into a plan.

This guide breaks down exact thresholds, historical cycles, and practical strategies you can use right now. We'll use real numbers, clear signals, and concrete examples—plus an explainer on why crypto's unique structure makes downturns sharper than traditional markets. Whether you're a beginner wondering why your investments are down or an experienced trader looking to refine your bear market strategy, this comprehensive guide will help you understand the mechanics, recognize the signs, and develop a plan to not just survive but potentially thrive during market downturns. If volatility keeps you up at night, start with our primer on Understanding Cryptocurrency Volatility.

What Is a Bear Market in Crypto?

A bear market is a prolonged period of falling prices and negative sentiment. In traditional finance, a 20%+ decline from a prior peak often marks a bear market. In crypto, deeper drawdowns are common: broad market declines of 50–85% can persist for 6–18 months, with sharp interim rallies that rarely break the longer downtrend.

Why so severe in crypto? The market is younger, more reflexive, and more leveraged. Liquidity is fragmented across centralized exchanges and on-chain protocols, and risk spreads quickly. Because assets like Bitcoin trade 24/7 and settle on blockchain rails without circuit breakers, forced liquidations can cascade in hours rather than days, accelerating selloffs.

Put simply: a crypto bear market isn’t just “lower prices.” It’s a regime change—volatility spikes, correlations shift, and capital becomes more selective. Surviving it requires different habits than trading uptrends.

How Bear Markets Form: The Mechanics

Bear markets typically form when multiple pressures stack:

- Macro tightening reduces risk appetite. Rate hikes and shrinking liquidity raise discount rates, compressing valuations for speculative assets.

- Leverage unwinds. Perpetual swaps, margin borrowing, and collateralized loans amplify both upside and downside. When price drops, liquidations trigger more selling.

- Confidence shocks hit trust. High-profile failures (exchanges, lenders, or protocols) can freeze credit lines and force asset sales.

- Regulatory uncertainty curbs flows. Headlines about enforcement actions or new restrictions can deter fresh capital.

For crypto participants, two practical lenses help: behavior and structure. Behavior shows up in fear-driven sells and shorter holding periods. Structure is visible in funding rates, basis spreads, and liquidity depth. Monitoring a simple sentiment gauge like the Fear and Greed Index alongside a market-structure checklist from our Bull or Bear Market guide creates an early-warning system you can actually use.

What a Crypto Bear Market Looks Like in Data

You’ll know you’re in one when the data stack points the same direction:

- Price structure: Lower highs and lower lows on daily/weekly charts persist for months. Failed breakouts fade faster, and rallies die at prior support.

- Volatility regime: Intraday swings expand. Even “green days” can be +8–12%, but without trend confirmation.

- Breadth and dominance: Fewer assets lead; Bitcoin’s market dominance often rises as capital consolidates into perceived safety.

- Liquidity and flows: Order books thin out; ETF inflows/outflows and stablecoin supply growth slow or reverse.

- On-chain stress: Exchange inflows and realized losses spike during capitulation waves, while long-term holders show reduced spending.

Tools can help contextualize the cycle. Long-horizon overlays like the Bitcoin Rainbow Chart are not trading systems, but they visualize multi-year valuation zones effectively. Heatmap views such as the Crypto Heatmap help track sector-wide weakness or rotating strength at a glance. Historically, non-Bitcoin assets suffer deeper drawdowns—many Altcoins fall 70–95%—and lower-liquidity coins may not recover at all after a cycle.

Historical Crypto Bear Markets (With Numbers)

History doesn’t repeat, but it rhymes. A few benchmarks:

- 2011–2012: Early-cycle crash. Bitcoin fell over 90% from June 2011 highs (-$32) to late-2011 lows (-$2), then slowly rebuilt liquidity and infrastructure.

- 2014–2015: Post-Mt. Gox unwind. Bitcoin declined ~86% from ~$1,150 in December 2013 to ~$152 in January 2015. This period birthed robust custody and exchange practices.

- 2018 “Crypto Winter”: After Bitcoin’s December 2017 peak at $19,783, price bottomed at $3,122 on December 15, 2018 (−84%). Ethereum fell roughly 94% from its January 2018 high to its December 2018 low.

- 2021–2022: From Bitcoin’s all-time high near $69,000 (November 10, 2021) to the November 21, 2022 low around $15,476 (−77%). The drawdown lasted ~12 months, followed by a gradual recovery; Bitcoin reclaimed new highs in March 2024 amid spot ETF adoption.

The lesson across cycles is consistent: liquidity dries up faster than fundamentals degrade, and rebuilds before headlines turn positive.

Psychology in Bear Markets: What Your Brain Gets Wrong

Downtrends test decision-making. Three biases tend to be costly:

- Recency bias: Overweighting the latest crash, you assume “it will only get worse” and sell near capitulation.

- Loss aversion: A 30% loss feels far worse than a 30% gain feels good, nudging you to hold losers too long or “double down” without a thesis.

- Herd behavior: Echo chambers amplify fear; with each new low, narratives grow more apocalyptic, even as risk may be declining.

Mini case study 1: Alex bought a small-cap token in April 2021, watched it run +300%, then round-trip to −85% by July 2022. Without a plan, Alex capitulated at −80%, locking in losses just before a +60% relief rally. Lesson: predefine invalidation levels and position sizes during euphoria—not mid-panic.

Mini case study 2: Mei started dollar-cost averaging (DCA) into BTC monthly from December 2021 to November 2022. While early buys were at higher prices, the blended cost basis improved with each lower allocation. By mid-2024, the position turned positive even before retesting prior highs. Lesson: mechanical rules beat emotional decisions in regimes you can’t time.

To keep judgment clear, build a personal research rhythm. Our DYOR (Do Your Own Research) guide outlines how to evaluate assets independently—and our Crypto Scams: How to Spot and Avoid Them article helps you avoid bad actors that proliferate in downturns.

Practical Strategies to Navigate a Bear Market

Your goal isn’t to call bottoms; it’s to survive, learn, and position for the next expansion. A balanced toolkit includes capital protection, process, and selective offense.

- Position sizing and DCA: Use small, fixed allocations at set intervals. DCA removes guesswork and reduces regret if prices drop another 20–40%.

- Rebalance toward quality: Consolidate into assets with durable networks and liquidity. Consider limiting exposure to illiquid coins that may never recover.

- Yield—carefully: On-chain yields and staking can offset drawdowns, but contract risk is real. Start with our Crypto Staking guide and use the Staking Calculator to model realistic APRs and lockups.

- Tax-loss harvesting: Realize losses to offset gains (subject to your jurisdiction’s rules). Review our Understanding Cryptocurrency Taxes before acting.

- Security first: Exchange collapses happen in bear markets. Prioritize self-custody with hardware wallets and tight opsec. See How to Safely Store Your Cryptocurrency for a step-by-step approach.

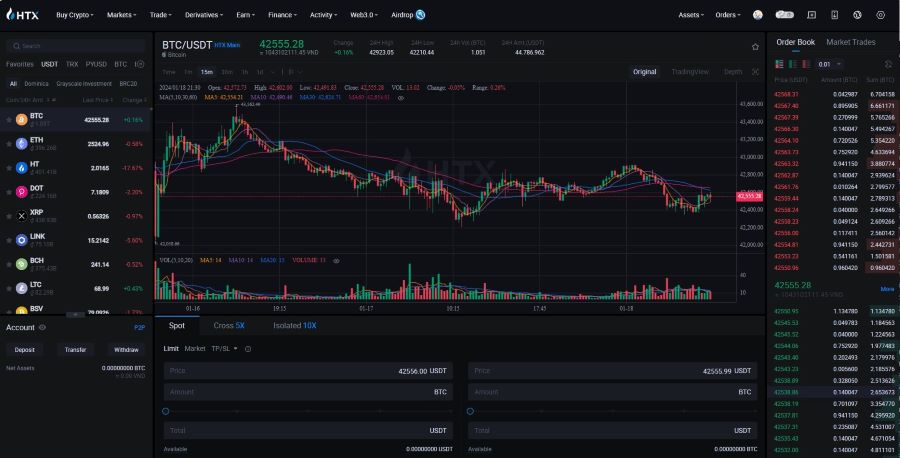

When buying, favor reputable venues and simple orders. Large market orders in thin books can move price against you. Major exchanges with fiat on-ramps and relatively deep liquidity include Coinbase, Binance, Bybit, Kraken and OKX, among others. For a complete comparison of exchanges, including fees, custody options, and features, see our exchanges directory.

Signals a Bear Market May Be Ending

No signal is perfect, but clusters matter. Watch for:

- Market structure: Higher lows on weekly charts and successful retests of prior resistance as support. Breadth improves—leaders expand beyond 1–2 coins.

- Liquidity and flows: Stablecoin supply growth turns positive; spot volumes rise without corresponding funding spikes. ETFs see net inflows.

- Sentiment and positioning: Perpetual funding normalizes near flat after prolonged negative prints. Our beginner-friendly Crypto Fear & Greed Index framework can help interpret shifts without overreacting to daily noise.

- Narrative catalysts: Real-world adoption, clearer rules, or new infrastructure. For example, spot ETF approvals in January 2024 changed the buyer base and improved liquidity. See Crypto ETFs Explained for how these vehicles bridge traditional and digital markets.

Think of these as overlapping green lights—not a single “all clear.” When 3–4 align, risk-adjusted entries improve, but your plan should still assume imperfect timing.

Risks, Limitations, and What Can Go Wrong

Bear markets include vicious “bear market rallies.” A +40% move in a week doesn’t end a downtrend if market structure and liquidity don’t confirm. Also, not all assets recover: historically, a significant percentage of small-cap tokens fail to revisit prior highs post-cycle due to token dilution, declining developer activity, or business model fragility.

Operational risk rises in downturns. Counterparty failures, paused withdrawals, or governance attacks can impair funds even when you “pick the right coin.” If you must use centralized venues, spread counterparty risk and avoid large idle balances. Learn the basics of venue selection and custody trade-offs before committing size.

Conclusion: Turn Panic Into a Playbook

Bear markets feel endless while you’re in them. But history shows they end—and the groundwork you lay during the quiet stretches often determines your next-cycle results. Define position sizes, automate DCA, harden your security, and concentrate on assets with real usage and liquidity.

Use objective tools and rules to keep emotion in check. Monitor structure, flows, and sentiment together; keep your plan simple enough to execute on bad days. When you’re ready to deepen your foundation, our guide to Bitcoin is a great primer, and learning to distinguish regimes with Bull or Bear Market will make every future decision easier.